ANGEL INVESTOR PROGRAM

Afrodescendant Leadership Alliance

Gain the critical skills needed to evaluate and invest in early-stage startups

Starts On

Applications

closed

Duration

6 Weeks

2X Per week

Program Fee

$650 CAD

Program Overview

The Afrodescendant Leadership Alliance has partnered with Marlon Thompson for the third year of the Angel Investor Program.

The stats on how little investment Black founders receive are bleak and it makes sense when you see just how little venture capital funding is in the hands of Black investors. This lack of investment in Black companies means less business innovation, missed market opportunities and a lack of economic inclusion. So what can we do? Diversify the face of investment.

The Angel Investor Program is for new and emerging investors and innovative leaders who want to develop their investment knowledge and start changing the game from the inside, by investing directly in companies, investing into venture funds or both. Through six virtual sessions (1 - 2 hours each) over 6 weeks, you'll shape your investment thesis, understand deal structures and flow and use your new skills to analyze an actual startup pitch from a Black founder.

The program starts April 23rd, taking place Tuesdays @ 3 PM PT/ 6 PM ET and Wednesdays @ 3 PM PT/ 6 PM ET.

Applications are now closed but you can join the waitlist for the next cohort.

Program Highlights

Online / Virtual

We provide a world-class learning experience in our virtual sessions, designed for collaboration and feedback.

Expert-Led

Learn from investors, founders, and subject matter experts with real-world experience and proven track records.

Coaching

Appointment-based coaching calls with industry professionals for tailored support that suits individual needs.

Networking

Establish new networks and long-lasting relationships with peers, investors, founders, or other industry professionals.

Agile Learning

We focus on speed, agility, and collaboration within each session to deliver the most relevant content in the most efficient way.

Program Schedule

-

Overview of the venture funding landscape from bootstrapping, to Initial Public Offerings (IPOs).

-

Understanding the potential of early-stage investments.

-

Breakdown the functionality of an investment thesis and a deep dive into strategies to develop a high-potential portfolio of angel investments.

-

An overview of the anatomy of a venture deal and developing a personalized process and strategy for reducing risk.

-

An introduction into the underlying financial models and key metrics that define startup success.

-

A look ahead into the various trajectories of a startup and how angels investors can participate in the journey beyond a check.

Program Team

-

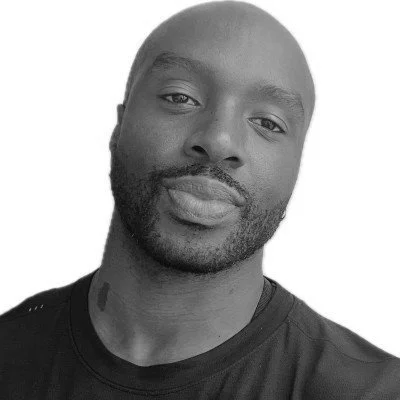

Marlon Thompson

Independent Investor in Residence

Marlon has spent over a decade working at the cross-section of innovation, economic inclusion and community. He is a seasoned executive, startup founder and career startup investor.

Marlon exited his first company in 2023 and has built an angel portfolio of pre-seed and seed investments in the CPG and consumer tech space with one exit to date. Marlon has also worked with a number of venture capital firms in a variety of roles including from director, advisor and venture partner.

-

Deborah Chima

Program Manager

Deborah is a strategy professional that enjoys partnering with the world's largest organizations to help them drive business value.

She is currently on the Strategy & Operations team at TikTok, where she is driving strategic initiatives to support the Canadian leadership team in expanding TikTok's monetization business in the Canadian market. Prior to joining TikTok, Deborah was a management consultant at Bain & Company.

Guest Speakers